Umbrella Lines

Umbrella Lines

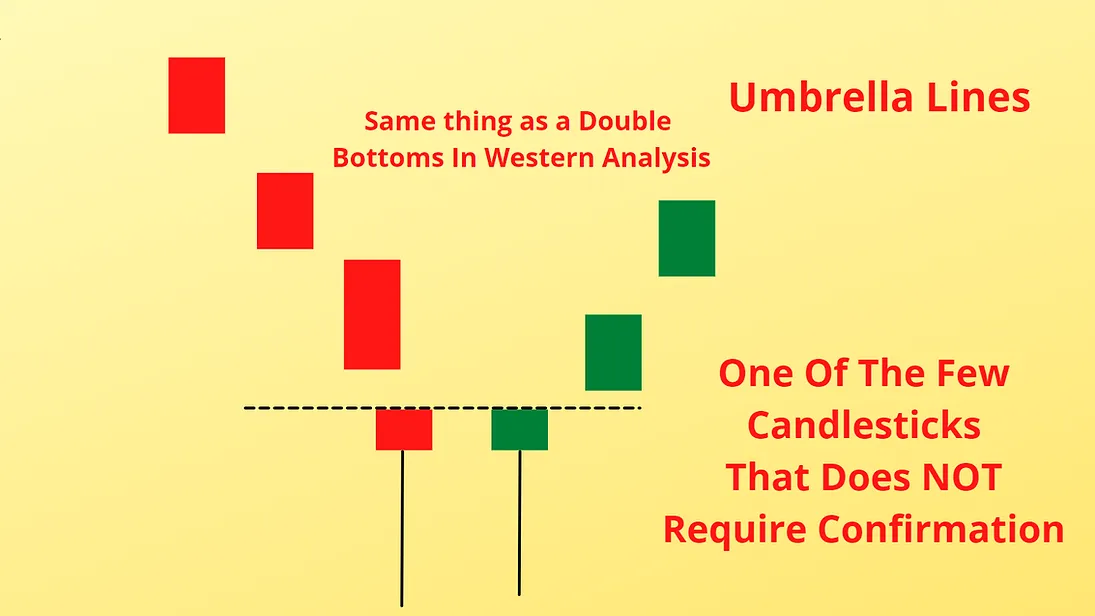

Lower Umbrella Lines are the same thing as Double Bottoms in Western analysis even if the lower shadows don't have the same low. If a Window appears the following day, it's really Bullish.

Umbrella lines forming at the BOTTOM of a trend are one of the few Candles that do NOT require confirmation. The color of either of the Candles does not matter. They are not a pattern that forms that often but when they do they can be an excellent opportunity to get long the market.

The color of either of the bodies is not very important but you do want a small real body on both Candles.

If you are thinking that Umbrella Lines look like double Hammers you are 100% correct which makes them even more powerful, signaling that the downtrend should end. If a single candle is a Hammer, Umbrella Lines are a sledge hammer.

Now envision a Japanese sledgehammer. Got that mental picture?

Click to enlarge the chart

Do you know how long it took me to find a Japanese sledgehammer? A very long time. Pretty isn’t it! :-)

The Japanese say that both Hammers and Umbrellas lines are trying to find a bottom. The longer the lower shadow the better. The reason is that a really long lower shadow shows that there was a lot of selling pressure that session, but the sellers lost control and gave it back to the Bulls.

You are going to see that Umbrella Lines at the TOP of a trend are very bearish. Several Japanese candlestick patterns are identical and form at the top or the bottom of a trend as you will see in the next chapters on Bearish Reversal Signals. In Western technical analysis, we have the same thing, like in top or bottom island formations.

Watch The Video